Yahoo Inc.

YHOO -0.23% has agreed to pay $1.1 billion for Tumblr, a six-year-old company with more than 100 million users but very little revenue, a deal that highlights the shifting balance of

power in the technology business.

More on Tumblr

In a 2012 interview, Tumblr's David Karp spoke to the Wall Street Journal about how he started the company and where he's headed with it.

Read the interview.

Timeline: A Changing Internet Pioneer

See key dates in the history of Yahoo, which helped to revolutionize the Web.

Veterans like Yahoo have shown they have staying power—and they have cash to spend. But companies like Yahoo's target, a blogging site, have something valuable as well: the rapt attention of fast-growing communities of users. That has pushed up the price tags as more established companies fear getting left behind as people's online habits evolve.

Yahoo's board has approved the all-cash deal to buy Tumblr, people familiar with the matter said Sunday. Tumblr's board also has approved the deal, one of the people said. A deal could be announced as soon as Monday, the person said.

Spokeswomen for Yahoo and Tumblr didn't respond to a request for comment.

The transaction would add Yahoo to the list of established

Internet companies, including

Google Inc.

GOOG +0.59%and

Facebook Inc.,

FB +0.46% that have spent $1 billion or more apiece to buy startup companies in hopes of gaining an edge in growth. Facebook, for instance, last year

paid cash and stock initially valued at about $1 billion to buy revenue-free Instagram, a popular photo-sharing service.

Google famously paid $1.65 billion in stock seven years ago for YouTube, the online-video behemoth. In a smaller deal, in dollar terms, but one that reflects the appetite among old-line Internet companies for fresh blood, AOL bought Huffington Post for $315 million in 2011.

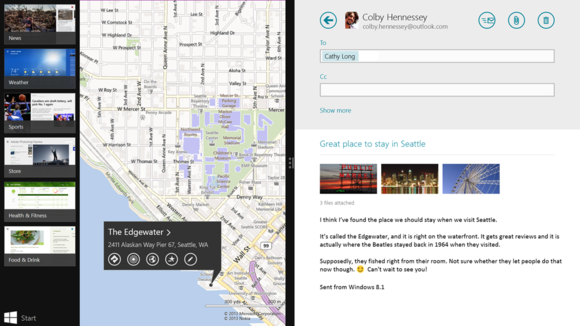

Yahoo Chief Executive

Marissa Mayer's deal for Tumblr would give Yahoo, one of the original big Internet companies, a fast-growing Web service that could fill one of its many holes—namely, the lack of a thriving social-networking and communications hub. Tumblr is popular with many younger adults, in contrast with Yahoo's older customer base. Tumblr is also growing more quickly on

smartphones than Yahoo.

Yahoo would be paying a premium for the company. When Tumblr last raised money, in late 2011, the $85 million venture-capital investment it received valued the company at $800 million.

The deal would be a big win for Tumblr CEO and founder David Karp, who remains a large shareholder, and the site's early venture investors, which include Union Square Ventures, Spark Capital and Sequoia Capital.

The acquisition would be a big bet for Yahoo, given Tumblr's financial performance so far. But Yahoo needs the growth. Its annual revenue has been stuck for years around $5 billion, and the company's big presence on personal computers hasn't translated well to mobile devices, where it lacks the advantage of

Apple Inc.'s

AAPL -0.30%coveted hardware or Google's ubiquitous smartphone operating software, Android.

NBC / Associated Press

Yahoo CEO Marissa Mayer's deal for Tumblr would give her company a social-networking and communications hub.

Meanwhile, Facebook and Google have demonstrated that a vast audience for free content can bring in significant advertising revenue.

New York-based Tumblr, founded in 2007, has 175 employees, more than 108 million blogs and, according to

comScore Inc.,

SCOR +3.85% had nearly 117 million unique users world-wide in March. That is up from around 58 million a year ago. The site is among a number of fast-growing startups, including online scrapbook Pinterest and news aggregation site Reddit.

Tumblr built that following by making it easy for people to create blogs and post writings, photos and videos. Tumblr users can follow other people's updates the way Facebook users follow friends—and easily share their work. With these features, Tumblr lowered the bar for online publishing and effectively merged blogging with social media.

In a pattern typical of young Internet companies, Mr. Karp, the CEO, has focused on increasing his site's user base while placing a lower priority on making money. The company didn't begin placing ads on its service until last year. In recent news reports, Mr. Karp, who once told the Los Angeles Times he was "pretty opposed to advertising," said Tumblr generated $13 million in revenue last year.

Yahoo plans to allow Mr. Karp to continue to run the site and operate largely separately from the rest of Yahoo, people familiar with the matter said.

Yahoo believes it could help Tumblr bring in more money by selling ads—boosting its own revenue in the process, people familiar with the matter said. Tumblr potentially offers personal data on millions of individual users, and an ability to help Web content go "viral" as friends share popular posts. Data is at the heart of Yahoo's ability to sell online advertising across its sites, based on what it knows about its people's interests.

Ms. Mayer, recruited to lead Yahoo last summer after a 13-year career at Google, became interested in Tumblr a couple of months ago, one of the people familiar with the matter said. Its sleek aesthetic fit with her vision for Yahoo, another person said. Last week, All Things Digital, which, like The Wall Street Journal, is owned by

News Corp.'s

NWSA +1.10% Dow Jones & Co., reported that the two companies were in talks.

There are several risks for Yahoo. A popular venue for teens, Tumblr includes many Web pages of racially insensitive, pornographic and other sexually oriented content. Such pages wouldn't be attractive to advertisers. There is also the risk of diminishing Tumblr's appeal among some users with too-aggressive a push to bring in advertising revenue. Writing on his Tumblr blog Saturday, John Saroff, a former Google executive, estimated Tumblr could generate $108 million or more a year based on the rates advertisers generally are willing to pay for graphical ads online.

But he said Tumblr was "correct" to resist filling its site with advertising since doing so could upset its core audience. He added that Tumblr, as a blogging platform, would likely have to get permission from Tumblr blog writers like him before it could place ads on the blogs and share revenue. He compared the business model to that of Google's YouTube video site, where the company shares revenue with video creators.

"It requires product vision, engineering talent, business development work and account management skills that took Google/YouTube years to grow with many fits and starts," Mr. Saroff wrote.

Facebook, concerned about alienating users, has yet to place ads in Instagram. Google also moved carefully in placing ads on YouTube, but the video site has since become a significant revenue generator. Google doesn't break out YouTube's financial information, but

Morgan Stanley MS +2.48% recently estimated that YouTube is on track to generate more than $700 million in operating income on about $4 billion in sales.

Ms. Mayer has made a number of moves to expand Yahoo's presence on mobile devices, freshen up its sites and boost its revenue. Acquisitions, however, also have long been expected to be part of her strategy.

Yahoo has a mixed record on the deal front. It acquired photo sharing site Flickr eight years ago but allowed it to be outpaced by new rivals like Instagram. It also explored but never consummated deals over the years with companies like YouTube, ecommerce site

eBay Inc.,

EBAY +1.63% online advertising company DoubleClick and Facebook.

While Ms. Mayer has continued to engage in early-stage deal talks with a wide range of video, social-networking and advertising-technology companies, according to people familiar with the talks, to date, she only has bought small companies for their engineering and product-management talent.

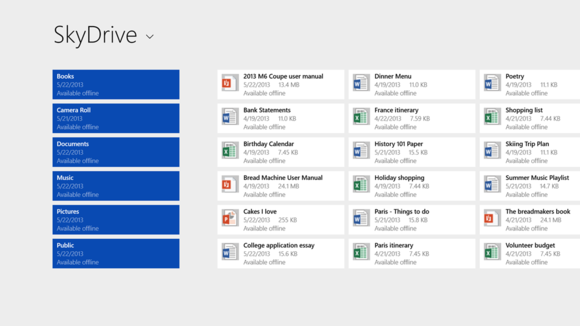

Yahoo recently pulled out of a roughly $200 million deal to buy a controlling interest in the video website Dailymotion, owned by France Telecom SA, because the French government said it would object to the deal, people familiar with the matter have said.

The valuations placed on social media sites like Tumblr make little sense under typical financial analysis. But big technology companies have become more willing to spend large amounts of money on such companies given the financial performance of social media companies such as YouTube, Facebook and Twitter, executives and investors said.

In the first quarter, Facebook saw $219 million in net income on almost $1.5 billion in sales, as mobile advertising soared to about 30% of its total ad revenue. Last year, Twitter generated $288 million in advertising revenue, according to research firm eMarketer Inc.

Bloomberg News

Yahoo recently pulled out of a roughly $200 million deal to buy a controlling interest in the video website Dailymotion.

Another one of Google’s I/O announcements, Google Play for Education is a new initiative that aims to make it easier for schools to implement mobile learning in classrooms. Google Play for Education is a customized, curated version of the Play Store designed for K-12 needs. Announcing the launch at the I/O event (Google’s annual developer conference), Google said the education-centric Play Store will launch this fall.

Another one of Google’s I/O announcements, Google Play for Education is a new initiative that aims to make it easier for schools to implement mobile learning in classrooms. Google Play for Education is a customized, curated version of the Play Store designed for K-12 needs. Announcing the launch at the I/O event (Google’s annual developer conference), Google said the education-centric Play Store will launch this fall.